From today’s NFP release and big tech’s impressive earnings to job data and New York Community Bancorp highlighting potential interest rate cut discussions, dive into the latest market insights and updates.

Big Tech Earnings Recap

The market began yesterday with advances in the main North American indices driven by a rebound in some of the largest market cap tech companies awaiting the quarterly earnings reports from Apple Inc., Amazon, and Meta.

Most notably, Meta shares skyrocketed after the announcement of its first-ever dividend release to investors and a $50B buyback, proving confidence in the company for some.

Here’s how the numbers came in:

Apple (AAPLE)

- Revenue: $119.58B vs. $117.91B expected

- EPS: $2.18 vs. $2.10 expected

Amazon (AMZN)

- Revenue: $170B vs. $166.2B expected

- EPS: $1.00 vs. .80 cents expected

Meta (META)

- Revenue: $40.1B vs. $39.18B expected

- EPS: $5.33 vs. $4.96 expected

Stock Indices Surge in Response to Earnings

The stock indices ended the trading session with an extraordinary performance rising over 1%:

At the close of the session, the earnings of the three large technology companies were announced and all of them beat expectations, Amazon with revenues of 170 B and EPS of $1, Meta with revenues of 40.11 B and EPS of $5.33 and Apple Inc with revenues of 119.5 B and EPS of $2.18.

FOMC and Powell’s Statement Continues to Push Bond Yields Down

Wall Strееt ignored Jerome Powell’s message that the Federal Reserve is unlikely to cut rates in March. Bond yields continued to decline after yesterday’s press conference and the market remains betting that interest rates will fall sooner rather than later.

Here are a few reasons why…

NFP Job Data Could Prove a Rate Cut is Sooner Than We Think

First, Powell’s statement that a worsening of the labor market could spark the decision to lower rates is having an effect. Today, we’re awaiting the Non-Farm Payroll employment figures. A report from yesterday revealed an unexpected rise in jobless claims to a two-month high, indicating a relaxing labor market. Economists are predicting that today’s data will show a payroll increase of about 185,000 for January. If this forecast is accurate or the numbers come in lower, it would further indicate a softening labor market and bolster expectations for upcoming interest rate cuts.

New York Community Bancorp Puts Stress on Banks

Another reason was the fear of a new crisis of medium-sized banks in the United States. Since yesterday, there has been talk in the market that New York Community Bancorp, a small bank that cut its dividend, due to capital needs citing stress in the commercial real estate sector, could be in serious trouble. That bank assumed some of the assets of failed banks last year.

Bond yields fell due to purchases of bonds as safe-haven assets, in the face of the news, and stocks briefly reduced their gains amid a decline in banks. Some sector analysts came out with statements downplaying the issue, calling it an isolated case and saying that the banking crisis is now behind us. But fear has reappeared and any more news of this nature could increase risk aversion in the market, which would put downward pressure on market interest rates.

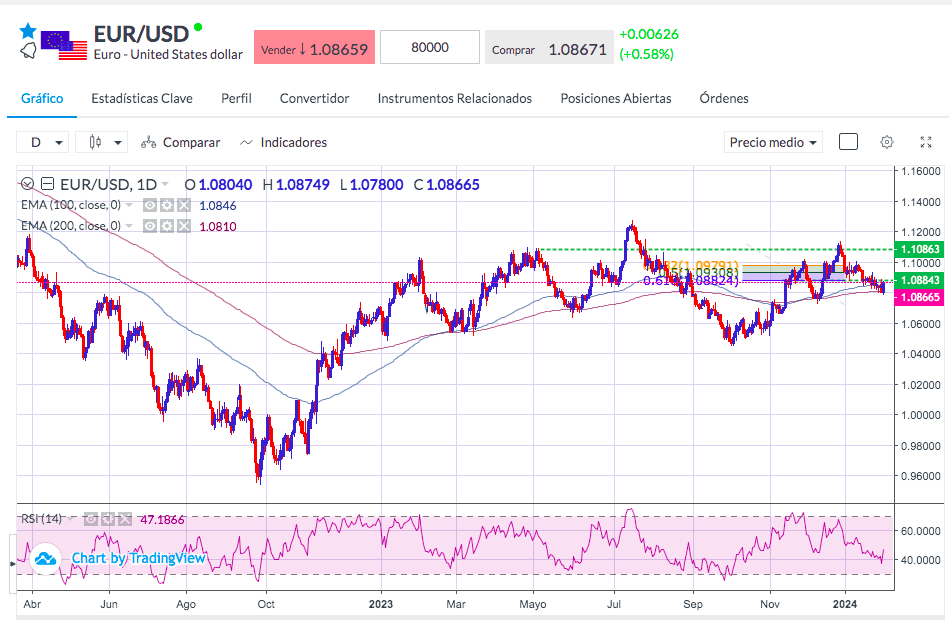

USD Reacts Downward to the Above NY Community Bancorp News

The US dollar weakened in this scenario of lower bond yields and the EUR/USD pair recovered more than 70 pips in the session.

EUR/USD daily chart, February 1, 2024. Source: EVP Market WebTrader.

Key Takeaways

- Apple, Amazon, and Meta all reported their quarterly earnings yesterday.

- All three companies beat the forecast showing strong growth.

- Interest rate cuts are still rocking while Fed statements put it off and some data shows it could be sooner.

- NFP figures are well-awaited today and it could push interest rate cuts closer.

- New York Community Bancorp plunges after a surprise dividend cut putting concerns on commercial real estate.

- EUR/USD soared in response.