If what goes up must come down, then the urgent question on the minds of many in the US, UK, or Europe is when will interest rates go down? For months, rates have been set at the highest in the Central Bank’s history. Investors have been betting that the central banks will cut rates quite soon — possibly in early Q2.

The market has long been pricing in interest rate cuts from major central banks toward the end of 2023 and then the beginning of 2024, but sticky core inflation, tight labor markets, and a surprisingly resilient global economy are leading some economists to reassess.

However, FED, ECB, BOE, and other major central banks are doing their best to keep the rate hike narrative alive and well, but markets have concluded since Q3 2023 that they are done and that the next move is down. Now it’s not so clear when will interest rates go down. Find out what economists and strategists are expecting over coming quarters.

When Will Interest Rates Go Down?

- US: The Federal Reserve is expected to cut interest rates from 3Q2024, with markets discounting 125-150 bps this year.

- Eurozone: The European Central Bank is expected to cut interest rates from 2Q2024, with markets discounting 75bps this year.

- UK: The Bank of England is expected to cut interest rates from 2Q2024, markets forecasting roughly 100bps rate cuts this year.

- Canada: The Bank of Canada is expected to cut interest rates from 2Q2024 and 150bps in total during the year.

- Australia: The Royal Bank of Australia is expected to cut interest rates with only 25bps during 4Q2024.

- Turkey: The Central Bank of Turkey is expected to pause rate hikes at 45.00 and cut interest rates from 4Q2024.

How long will interest rates stay high?

The major central banks around the world have raised their interest rate multiple times since the beginning of 2022, boosting it from near-zero up to even 5% to cool down the scorching inflation that set in as the economy recovered from the pandemic.

The rate hikes have added friction to the economies in several ways, putting upward pressure on credit cards, mortgages, and other consumer loans. High interest rates have also made business harder for banks, which have grown more reluctant to lend money.

Both of those factors have dragged down the ability of consumers to buy things, and of businesses to hire and expand, raising fears of an impending recession. To the surprise of many economists, however, unemployment has stayed low, and a severe slowdown has yet to materialize, while inflation has simmered down.

At some point, the Central Banks will shift out of inflation-fighting mode and begin to lower interest rates again, though that day could be a long way off.

They could keep its benchmark interest rate at least at its current level—the highest since 2001 in the US or 2008 in the UK, and a record high in the EU—through the first part of 2024.

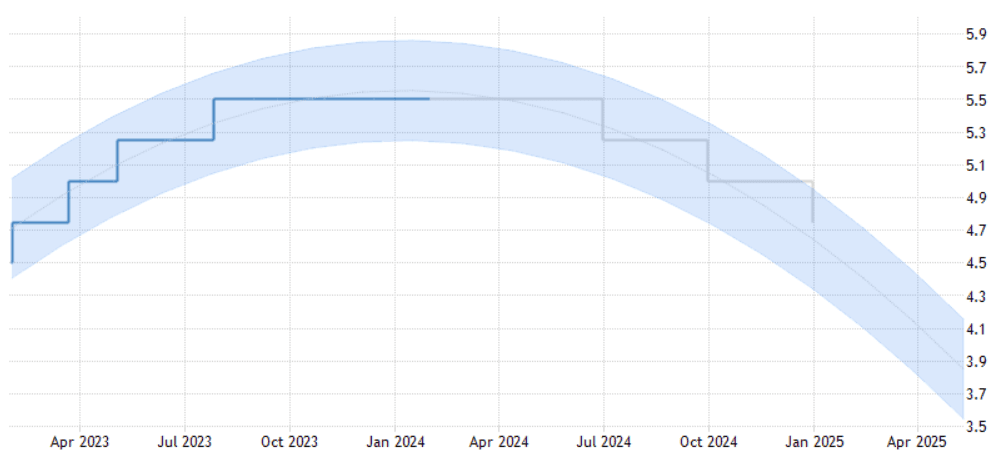

When will interest rates go down in the US?

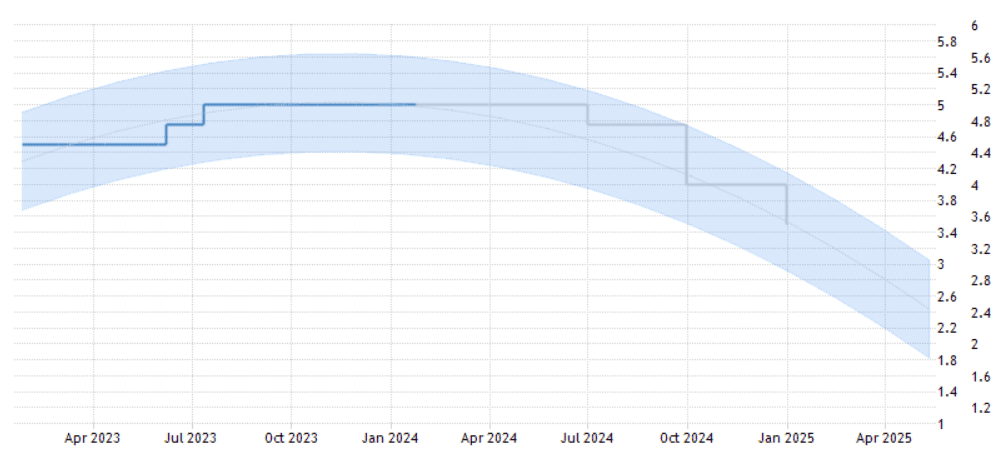

According to the US interest rates forecast for the next 5 years (projected interest rates in 5 years in US), the 25bp hike in July marked the top. A 12-month pause and then 1000bp of rate cuts starting with the third quarter of 2024, with Fed funds projected to hit 4.5% by the end of 2024.

The Fed’s current view is that the neutral Fed funds rate is 2.5%, signaling scope for 300bp of rate cuts just to get us to ‘neutral’ policy rates. Moreover, the ‘real’ policy rate, adjusted for inflation, will continue to rise as inflation moderates.

ING analysts believe the Fed will choose to wait until May to make the first move, with ongoing subdued core inflation measures giving it the confidence to cut the policy rate down to 4% by the end of this year versus the 4.5% consensus forecast, and 3% by mid-2025.

This will merely get us close to neutral territory. If the economy does enter a more troubled period and the Fed needs to move into ‘stimulative’ territory there is scope for much deeper cuts.

Interest Rates Forecast in the US

Traders are pricing in a 73% chance that the Fed could lower rates in March, according to the CME’s Fed watch tool. According to Goldman Sachs, the Fed will start cutting the funds rate soon, most likely in March, as Chair Powell said at the December 13 press conference that the committee would want to cut ‘well before’ inflation falls to 2%. However, they expect ‘only’ five cuts this year, below the six-to-seven cuts now discounted in market pricing, and they view the chance of 50 basis points steps as low.

According to Trading Economics global macro models and analysts’ expectations Interest Rate in the United States is expected to be 5.25 percent by the end of this quarter. In the long term, the United States Fed Funds Rate is projected to trend around 4.75 percent in 2024 and 3.75 percent in 2025.

Why could interest rates go down in the US from 1Q2024?

After the most aggressive monetary policy tightening cycle in 40 years, cracks are starting to form. The housing market is deteriorating, business sentiment is in recession territory, and recent banking stresses mean lending conditions will tighten considerably. The chances of a hard landing for the economy are rising, which will mean inflation falls more quickly. The Fed’s dual mandate of price stability and maximum employment gives it the flexibility to respond swiftly with rate cuts.

Why could interest rates in the US stay high for a longer time?

Persistent service sector inflation caused by labor market tightness could see the Fed hike for longer. Conversely, the tighter lending standards, a debt ceiling crisis/government shutdown, and a restart of student debt repayments may create an even deeper downturn that triggers a more aggressive Fed rate cut response.

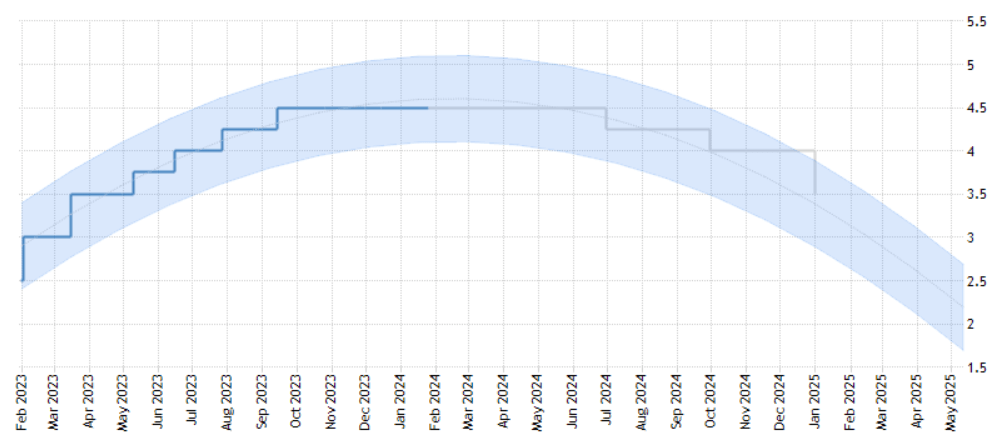

When will interest rates go down in the EU?

The EU interest rates forecast for next 5 years (projected interest rates in 5 years in EU) shows the first-rate cut will not be before the second quarter of next year, and should coincide with the decision to gradually stop reinvestments of purchases assets under its Pandemic Emergency Purchase Programme (PEPP).

The ECB lowered its key rate to 0% in 2016, maintaining the zero-rate policy until July 2022, when it raised Eurozone interest rates to 0.5% – the first rate hike since 2011 – to curb the soaring inflation.

Since then, the European Central Bank raised interest rates for the ninth consecutive time in July 2023 by a combined 425 basis points since July 2022, worried that price growth could be perpetuated by both rising costs and wages in an exceptionally tight jobs market.

There has been a shift at the central bank recently. In December, Ms. Lagarde said rate cuts hadn’t been discussed and emphasized the need to be vigilant against inflation. But the new year brought a slight change of tune. At the beginning of 2024, Ms. Lagarde said that it was likely that rates could come down in the summer.

However, the 26-member Governing Council still agreed that it is “premature to discuss rate cuts,” and policymakers would make their decisions based on incoming economic data, not by following a calendar.

Interest Rates Forecast in EU

Markets are pricing in around a 60% probability of the first-rate cut taking place in April, according to a Reuters analysis of LSEG data. High expectations for a March cut have been pushed back in recent weeks, but April pricing is staying put despite numerous ECB officials arguing that trims may be premature.

UBS is calling an April cut — but not with confidence. Société Générale economists are taking an even more cautious approach moving their first rate cut from December to September 2024, but highlighted that there is high uncertainty as regards the data, implying that no cuts this year are also a possibility.

Interest Rate in the Euro Area is expected to be 4.50 percent by the end of this quarter, according to Trading Economics global macro models and analysts’ expectations. In the long term, the Euro Area Interest Rate is projected to trend around 3.50 percent in 2024 and 2.50 percent in 2025, according to our econometric models.

Why could interest rates go down in the EU from 2Q2024?

The ECB no longer desires to serve as the unrestricted lender of last resort for the eurozone’s financial markets, national governments, or economic system. Even though headline inflation will decline even more, there is enough pipeline pressure in the services sector and persistently high core inflation to support future rate increases and a “high for longer” strategy. Even if tighter monetary policy further erodes the eurozone’s economic outlook, the ECB won’t consider changing its current course until both predicted and actual inflation are clearly moving back toward 2%.

Why could interest rates in the EU stay high for a longer time?

The pressure on service prices is the most intriguing aspect of the inflation dynamic, and the ECB is likely to pay close attention to it. While the inflation rate for goods is still declining, the price pressure for services has continued to rise in tandem with wage growth and increased demand.

ECB cannot imagine that we’ll talk about cuts yet, because we should not talk about it. Everything we have seen in recent weeks points in the opposite direction, so I may even foresee no cut at all this year, according to ECB arch-hawk Robert Holzmann.

According to economists, the most recent data opens the possibility of another rate increase by the ECB before the end of the year, possibly even in September.

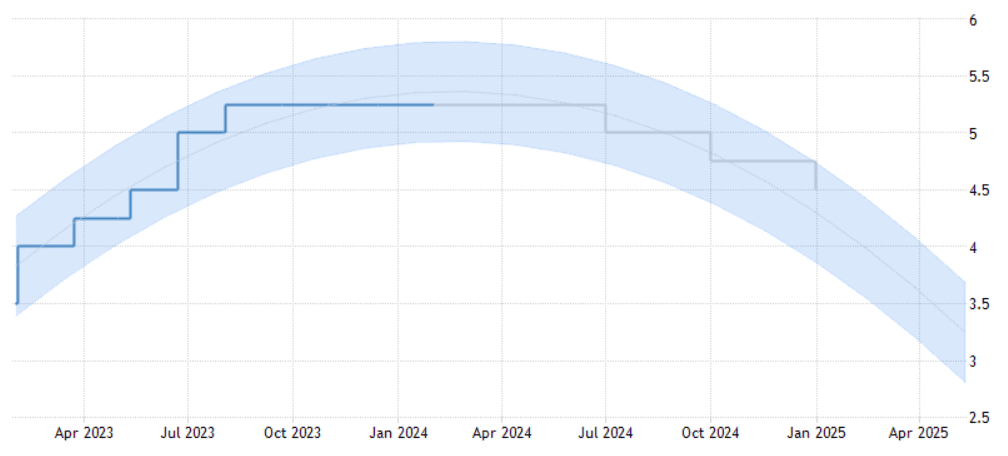

When will interest rates go down in the UK?

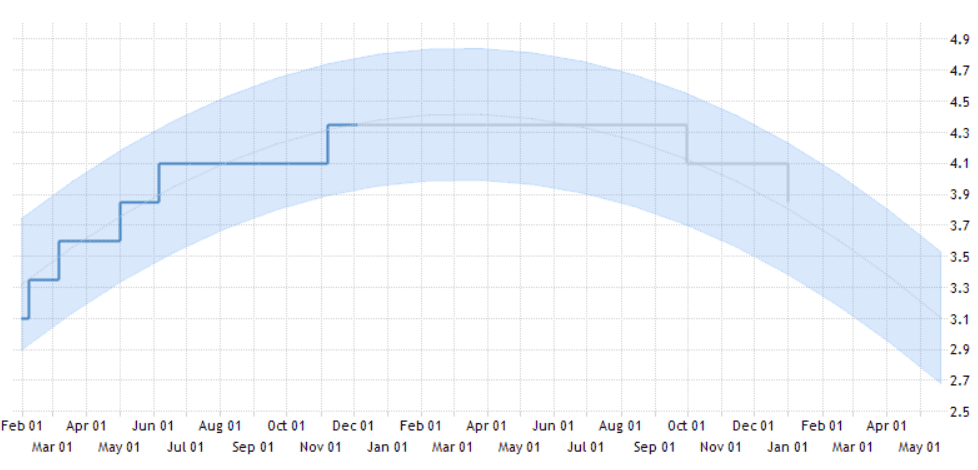

The UK interest rates forecast for the next 5 years (projected interest rates in 5 years in the UK) shows that interest rates will go down from the end of 2Q2024.

In March 2020, BoE implemented two interest cuts – on 11 and 19 March – which brought the UK interest rates to an all-time low of 0.1%. The BoE’s steep rate cut followed in the footsteps of other central banks and governments that rolled out emergency measures to help their economies weather the pandemic.

The near-zero rate was kept until December 2021 as the UK and other countries gradually reopened their economies.

As inflation rose in line with recovery, the BoE increased its bank rate to 0.25% on 16 December 2021 from the low of 0.1%. The UK became the world’s first leading economy to increase its interest rate after the pandemic.

In 2022, the BoE hiked rates eight times, bringing it to 3.5% by the end of the year. In 2023, the UK central bank hiked rates two times by 50 basis points (bps) and three times by 0.25%, bringing the rate to 5.25%.

The Bank of England’s tightening cycle has almost certainly finished, and policymakers are putting a lot of energy into convincing investors that rate cuts are some way off. That said, they haven’t ruled out easing in 2024, and the door is wide open to rate cuts by summer.

Interest Rates Forecast in the UK

Falling inflation has prompted a flurry of bets on rate cuts. Investors now believe the first rate cut will be in May and are pricing in four rate cuts this year meaning that by the end of 2024, the interest rate will stand at 4%.

Goldman sees a first 25 basis point cut in May, followed by further quarter-point increments at every meeting until the bank rate reaches 3% in May 2025.

According to Trading Economics’ global macro models and analysts’ expectations, the Interest Rate in the United Kingdom is expected to be 5.25 percent by the end of this quarter. In the long term, the United Kingdom Interest Rate is projected to trend around 4.50 percent in 2024 and 3.50 percent in 2025.

Why could interest rates go down in the UK from 2Q2024?

Economists say the time is approaching for the BoE to relax its tough line on borrowing costs – something the U.S. Federal Reserve and the European Central Bank have already done – after recent data on headline inflation, wages, and economic growth all came in weaker than the central bank had expected.

According to a Reuters poll, 38 of 70 economists forecasted the interest rates in UK will go down from Q2. Answering an additional question such as “When will interest rates go down in the UK in 2024” the majority said May is more likely than June.

It’s May rather than June simply because it ties in with the second-quarter monetary policy report. For the Monetary Policy Committee, it’s going to be a question of evaluating underlying trends.

Why could interest rates in the UK stay high for a longer time?

The BoE’s updated narrative is likely to be that clear progress is being made on inflation, but that it is too early to declare victory, and therefore caution must be exercised when thinking about when and how quickly policy can be normalized.

When will interest rates go down in Canada?

The Canadian interest rates forecast for the next 5 years (projected interest rates in 5 years in Canada) shows that interest rates will go down from the end of 1Q2024.

At the beginning of the COVID-19 epidemic, the BoC cut its overnight rate three times, from 1.75% to 0.25%. Canada’s GDP contracted during that time by 5.5%, and inflation was expected to fall below 2% by 2020. Up until the first quarter of 2022, the bank maintained its key rate at 0.25%.

As inflation climbed to 5.1% in March 2022, the BoC started boosting interest rates by 25 bp to 0.50%. Since October 2018, it was the first rate rise by the BoC.

The BoC continued to hike rates, following in the footsteps of other central banks such as the US Federal Reserve (Fed) and the Bank of England (BoE). With the 10th rate hike in July, the overnight rate stays at 5%, marking the first time since April 2001 that the figure hit five percent.

Bank of Canada hit a pause on those hikes for a few months to determine whether the economy had sufficiently cooled. If you read through the latest bank projection, you can probably put the pieces together yourself. The bank expects inflation to decelerate to 2.5 percent by the end of the year. It believes the economic growth will remain near zero percent but won’t dip into a recession.

So, most economists expect the central bank will start lowering interest rates by the summer.

Interest Rates Forecast in Canada

The Bank of Canada will wait until at least June to cut its key interest rate as price pressures remain sticky, according to a firm majority of economists in a Reuters poll.

CIBC Capital Markets see no reason to alter their call for the first [quarter-point] cut to come in June, and for the bank to surpass market expectations by delivering a total of 150 basis points in cuts by the end of this year.

According to Trading Economics global macro models and analysts’ expectations Interest Rate in Canada is expected to be 5.25 percent by the end of this quarter. In the long term, the Canada Interest Rate is projected to trend around 3.50 percent in 2024 and 3.00 percent in 2025.

Why could interest rates go down in Canada from 2Q2024?

Weary Canadian households, clobbered by nearly two years of rising prices and skyrocketing interest rates, will need a relief on their borrowing costs. Economists expect slower price growth alongside a weakening economic backdrop will push the [Bank of Canada] to start gradually lowering the policy rate by mid-year.”

Trading in investments known as swaps — a type of investment where traders can essentially bet on where they think rates will be — implies there’s about a 97 percent chance of a rate cut by the Bank of Canada’s policy meeting on July 24.

Why could interest rates in Canada stay high for a longer time?

Despite the economy slowing because of the BoC’s 475 basis points of rate hikes, progress on inflation has remained uneven. The latest data showed consumer prices rose 3.4% year-on-year last month from 3.1% in November, above the central bank’s target of 1-3%. That, alongside high wages and elevated core inflation, may further weaken the case for an early rate cut.

When will interest rates go down in Australia?

The Australian interest rates forecast for the next 5 years (projected interest rates in 5 years in Australia) shows that interest rates will go down from the end of the 4Q2024.

The interest rates in Australia have gone up 13 times since May 2022 for a total of 425bp, lifting the cash rate from 0.1% in April to 4.35% in November, a 12-year high, as inflation picked up.

The Reserve Bank of Australia (RBA) paused its tightening cycle and is expected to keep the actual levels and not be forced to hike again. Australia’s inflation rate retreats to a two-year low fanning hopes the next RBA move will be a rate cut.

However, RBA Governor Bullock said, “The central bank must be a ‘little bit careful’ with using rates to bring down inflation without lifting unemployment.” Unlike FED and ECB, RBA looks set to wait at least until the third quarter of 2023, with the possibility to pause during the entire year.

Interest Rates Forecast in Australia

AMP is expecting the RBA will start lowering interest rates in June. They are forecasting three interest rate cuts in 2024, bringing the cash rate down to 3.6 percent by the end of the year. Bank of America says the RBA will be reluctant to cut rates until 2025, given how long it will take to return to their inflation targets.

The Commonwealth Bank believes the cash rate will be lowered by 0.75 percent by the Reserve Bank of Australia (RBA) over 12 months, starting in September 2024. It means interest rates could fall from 4.35 percent to 3.6 percent by the end of 2024.

According to Trading Economics’ global macro models and analysts’ expectations, the Interest Rate in Australia is expected to be 4.35 percent by the end of this quarter. In the long term, the Australia Interest Rate is projected to trend around 2.85 percent in 2025.

Why could interest rates go down in Australia from 4Q2024?

The Reserve Bank needs to start cutting interest rates now to take pressure off households,” he posted on social media on Thursday. “And there’s no rule the banks can’t cut their rates first. Many of them lifted their rates before the RBA.” His comments were mirrored by Victorian Premier Jacinta Allan and Western Australia counterpart Roger Cook.

Why could interest rates in Australia stay high for a longer time?

If the RBA forecasts are broadly accurate (admittedly a big if) and inflation is only just below 3 percent in late 2025, or it slips into 2026 as the IMF suggests, the RBA could postpone cutting interest rates in 2024. Of course, official forecasts have been wrong before, so it’s possible inflation returns to target faster than predicted.

When will interest rates go down in Turkey?

The Turkey interest rates forecast for the next 5 years (projected interest rates in 5 years in Turkey) shows the end of the rate-hike cycle. However, the CBT keeps hawkish bias in place.

Turkey’s interest rates had a history of extreme volatility, followed by a period of comparatively stable conditions for the majority of the 21st century while the CBT underwent significant structural reforms in the wake of the 2001 financial collapse that precipitated the country’s economic catastrophe.

Turkey was mostly successful in keeping inflation around 10% between 2005 and 2017, and interest rates followed suit by remaining quite low. Rates dropped as low as 4.5% in 2013, as the nation moved towards the Western economic paradigm of gradual price growth in the wake of the Great Recession.

In reaction to a substantial increase in inflation in 2019, rates increased as high as 20.35 percent before dropping with the inauguration of a new central bank governor. Rates decreased to 8.25% in response to COVID-19 limits that stifled demand before increasing to 19% by March 2021.

A few days after the increase, Erdogan fired Naci Agbal as governor of the Central Bank of the Republic of Turkey. Since then, the rate has continued to decrease because of the president’s insistence. Despite rising prices, it reached 8.5% in March as inflation concurrently ballooned, breaching 80% in late 2022.

Turkey’s central bank jacked up the country’s key interest rate by 3,650 basis points since June, when President Tayyip Erdogan appointed former U.S. banker Hafize Gaye Erkan as its governor to conduct a sharp pivot toward more orthodox policies.

Turkey’s central bank completed its aggressive tightening cycle with a 250-basis point, opened a new tab interest rate hike to 45% in January 2024, as expected, and said it would maintain current levels “as long as needed” to bring about the desired disinflation.

Inflation and inflation expectations will need to have fallen a long way before the central bank starts to cut interest rates.

Interest Rates Forecast in Turkey

Although inflation in Turkey increased to 64.8% year on year in December, ING economists are forecasting that interest rates will go down by the end of the year with 50bps.

According to Trading Economics global macro models and analysts’ expectations Interest Rate in Turkey is expected to be 45.00 percent by the end of this quarter. In the long term, Turkey’s Interest Rate is projected to trend around 25.00 percent in 2025 and 12.00 percent in 2026.

Why could interest rates go down in Turkey from 3Q2024?

The Central Bank of Turkey acknowledges inflationary pressures despite the underperformance of the consensus in the previous two meetings and attributes the rise in the underlying trend to strong domestic demand, cost pressures related to wages, foreign exchange, tax increases, and a deterioration in pricing behavior.

The bank predicts a transition into a period of deflation and stabilization, with inflation reaching a top of about 60% in the second quarter of 2024.

Why could interest rates in Turkey stay high for a longer time?

The current level of rate hikes is unlikely to get the central bank to its year-end 2024 inflation target of 36%, according to Selva Demiralp, professor of economics at Koc University. Demiralp and her colleagues instead see a reading closer to 50%, with inflation peaking around 75% in the middle of the year due to the cumulative effect of rate hikes and base effects.

The starting point was a very overheated economy, and consequent tightening is probably not sufficient, according to the economist.

In sum, will Interest rates go down in March 2024?

Even if it appears that the acute part of the crisis is gone, there is a growing perception that the recent banking stresses will have an impact on the world economy. In many cases, the most aggressive central bank tightening cycle in decades has caused cracks to begin to appear in the economy’s most interest-sensitive sectors. Rate reductions are imminent, and markets anticipate the major central banks to begin relaxing monetary policy before the end of the year.

However, for the time being, policymakers are confident they have the resources at their disposal to address financial system fragilities when they arise, allowing monetary policy to stay firmly anchored on inflation. Considering that inflation figures continue to show uncomfortably high levels across major nations, anticipate this narrative to prevail at future central bank meetings.

With some notable exceptions, central banks across the developed world look are likely to start cutting from the second quarter of 2024.

Free Resources

Before you start using the above interest rate forecasts from central banks, agencies, and analysts, you should consider using the educational resources we offer like EVP Market Academy or a demo trading account. EVP Market Academy has lots of free trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you become a better trader or make more informed investment decisions.

Our demo account is a suitable place for you to get an intimate understanding of how trading and investing work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged securities.